Continuing to share topical learnings and observations from my perch co-managing a $100M family of investment funds and a network of 20 fund managers who invest in more than 25 emerging economies, here’s a topic that we’ve been thinking about frequently: what comes after (or alongside) Ed-Tech? You may also be interested in my previous post about network-wide observations regarding the rise of remote due-diligence, here.

The hottest sectors in our portfolio are Ed-Tech

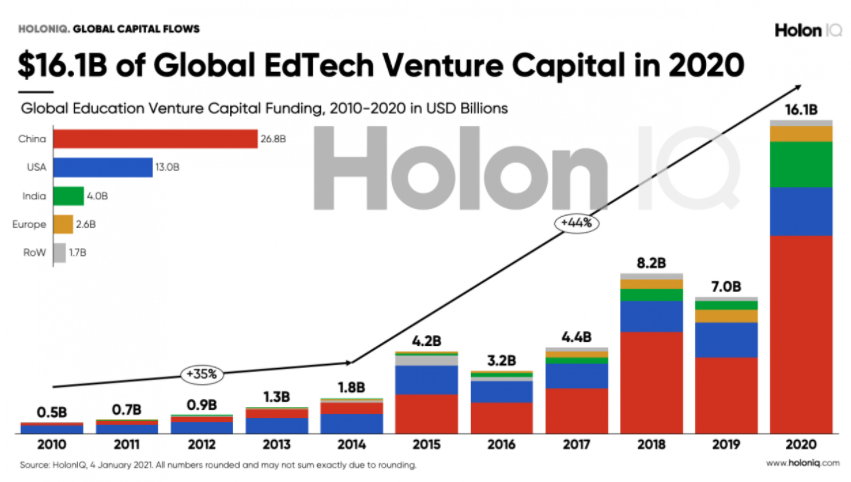

We made our first Ed-Tech investment as a private investor in 2010 when very few professional investors looked at the sector. As a partner at Unitus Ventures in India, we led our first Ed-Tech investment in 2014 — even then the sector was nascent. Fast forward to the pandemic acceleration of 2020 and you see an exciting broad-based capital flow into the sector of over USD $16B.

One of our India partners is showing a 30+x return on its earliest Ed-Tech investment, with more upside to come. But new investors coming in are paying higher prices every day, pushing the sector out of the early-stage value investing category. Edtech is here to stay thanks in part ot the pandemic. But what are the next cool-new-tech unicorns going to be born?

Job-Tech: consumers and businesses monetizing education

There are two primary customers in Ed-Tech: governments (or private institutions) and parents. The end-user rarely pays, as they are students with little discretionary income. And Ed-Tech is typically a cost centre for both customer segments – it’s either an investment in service delivery efficiency (or in a pandemic world, in delivery vs. non-delivery) or an investment by parents in the future of their children.

Job-Tech also has two classes of customers, but they are different: employers use job-tech to enable them to make better and more efficient hiring decisions and to manage their workforce, and job seekers use Job-Tech to get better jobs. The beauty of Job-Tech is that, unlike ed-tech, the services enabled through Job-Tech are exceptionally close to a point of monetization. That means Job-Tech expenditures are directly linked to employee lifecycle management costs of employers, large and small, and they are also linked to step-function increases in income for job seekers.

First-generation Job-Tech focused only on white-collar jobs

Three high-flying examples of first-generation Job-Tech companies include LinkedIn (now owned by Microsoft after a modest USD $26B acquisition), Workday which has delivered a nearly 500% increase in share price over the past 5 years, and Recruit Holdings that is trading at 22% over its pre-pandemic high and 2x it’s pandemic low, owners of Indeed and Glassdoor and 364 other global subsidiaries and affiliates delivering job-related HR-Tech, media, and staffing services.

![]()

These and most others in the field have been monetizing the point of employment of primarily white-collar workers, and/or providing staffing services for blue and white-collar workers. While there is plenty of upside still to find in the business of serving enterprises and white-collar professionals, the space is crowded, deals are very expensive, and many would argue that the exceptional alpha has largely been captured.

The next frontier: Job-Tech for the next 5 billion

From our vantage point of having investment partners in the major entrepreneurial hubs that are surrounded by some 3.7 billion people representing USD $13.2T in GDP, dominated by middle- and lower-income families, we are seeing the next generation of Job-Tech companies starting to form in order to serve the very different needs of both companies and individuals in the global south. The young populations of these countries are coming of age every month, and aspire to be employed outside of agriculture and informal sectors. You can find statements like the following for virtually every region and country in the global south:

-

- “Approximately one-fifth of young Latin Americans, or roughly 30 million people, are not employed or engaged in any form of education or training”

- “Sub-Saharan Africa has the highest rate of working youth in poverty: 69% of youth in sub-Saharan Africa who have jobs live in poverty (less than USD $3.10 per day)”

- “In India, 4 out of 10 youth who received vocational training are out of the labor force, and a significant chunk of those in the workforce remain unemployed”

On the brighter side, these same youth and young adults who are so under-employed are largely digitally literate, have access to smartphones with data, and are increasingly mobile and willing to travel for work when work is guaranteed. This leads to some exciting opportunities for job-tech companies to facilitate and manage employment at a mass scale, in both formal and gig employment sectors.

HR startups are hot in Silicon Valley and LatAm

Crunchbase lists more than 1,500 HR startups globally, with over USD $12B in total funding, 58% of which landed in Silicon Valley. One way these startups are changing the workplace in Latin America is by providing new ways for people to find work opportunities. With team members “all over the world”, Torre is global but strongest in the LatAm market. They describe themselves as “a recruitment platform, matching talent from unconventional careers with fulfilling professional opportunities.” I’d call them a “LinkedIn for global giggers and digital nomads.” In 2020, the pandemic was good to Torre – they added nearly one million job seekers to their platform. With the rise of freelancing and remote-work, McKinsey predicts that by 2025, “up to 540 million individuals may benefit from online talent platforms.”

BetterPlace places and manages blue-collar workers at scale in India

One of the great success stories of India’s growth in the past 5 years has been the emergence of the gig economy, where ride-sharing and logistics companies create opportunities for millions to work for generally decent wages while delivering goods and services to growing urban populations. Three leading gig economy companies, Uber, Ola, and Swiggy collectively “employ” more than 3 million drivers / delivery partners in India. The largest suppliers of security personnel collectively have some 7 million employees. These vastly different sectors share a common factor: astronomically high turnover, in some cases approaching 100% per quarter! That’s where Betterplace comes in: going a few steps beyond the recruitment focus of Torre described above, Betterplace manages everything from sourcing blue-collar employees and giggers and verifying their identity while screening for criminal complaints, to onboarding and providing payroll services for leading new- and old-economy companies including Amazon, Flipkart, JLL, Swiggy, and Zomato. They supply the full lifecycle for blue-collar employment, with over 18 million job seekers on their platform, growing rapidly.

Conclusion

Capria’s partners who are deeply connected to their local entrepreneurial ecosystems are not walking away from the overheated Ed-Tech sector, but they are being more careful with valuations, and investing earlier where needed to ensure they get the best deals. Many of our partners across all three geographies are seeing an increasing pipeline of Job-Tech companies and are making some big bets. While a pandemic was needed to fully propel Ed-Tech into the global mainstream, I’m confident that job-tech innovators will continue to grow and thrive, accelerated by the pandemic-driven shift to the digitalization of everything, and offering exceptional alpha to those who can find the best deals before others.