As we approach the end of 2020, which many of us would prefer to just do over again, there are many things on my mind, but three stand out from the perspective of investing in emerging markets: embracing remote due-diligence to keep investment programs going; optimistic growth trajectories for 2021, and building more resilient portfolios. Please also see my previous insider post on “A V-Shaped Recovery?“

Embracing Remote Due Diligence

I recently asked a few multi-$B asset managers “When do you think you will write a check for more than $10M to a company or fund where you or your team has not met the principal in person”. The resounding answer was “never”. At the same time, a recent study by Omers Ventures of 150 VCs indicated that more than 40% of respondents had already made investments in companies without meeting them. And a $100M Bay Area fund, Rocketship, has an investment thesis that envisions never needing to meet the founders they will invest in across the globe – their data-science powered AI tells them what companies are good investments, and the rest is done over zoom and chat. Only time will tell if Rocketship’s model will work. It’s an outlier, but it’s innovative and has significant promise, even more so now in a pandemic world.

Our firm and many others have continued investing through the lockdowns, albeit a bit more slowly, simply by mining the deep pipeline we all had built pre-COVID and investing in people we have known for some time already. But without new relationships being built, the trusted-in-person pipeline will run dry soon enough. I think there’s only one answer, which is to embrace tech and the new-normal, build deeper networks of associative trust (meaning I trust X, X knows and trusts Y, thereby I’m willing to trust Y), and plan to make decisions from afar for at least the next year, if not longer. Susana Garcia-Robles, who recently joined us as a Senior Partner after a 20-year career growing the VC ecosystem in LatAm for the Interamerican Development Bank, took a deep dive into remote DD in a recent blog here. Amit Garg of Tau Ventures recently wrote about his $450M exit from an investment he made in an entrepreneur he had never met.

Our firm and many others have continued investing through the lockdowns, albeit a bit more slowly, simply by mining the deep pipeline we all had built pre-COVID and investing in people we have known for some time already. But without new relationships being built, the trusted-in-person pipeline will run dry soon enough. I think there’s only one answer, which is to embrace tech and the new-normal, build deeper networks of associative trust (meaning I trust X, X knows and trusts Y, thereby I’m willing to trust Y), and plan to make decisions from afar for at least the next year, if not longer. Susana Garcia-Robles, who recently joined us as a Senior Partner after a 20-year career growing the VC ecosystem in LatAm for the Interamerican Development Bank, took a deep dive into remote DD in a recent blog here. Amit Garg of Tau Ventures recently wrote about his $450M exit from an investment he made in an entrepreneur he had never met.

Finally, Capria recently launched a short but hard-hitting evaluation tool and checklist to help managers determine if they were embracing the best concepts in remote due diligence and adjusting their investment thesis to match.

2021 Sentiment from Emerging Markets: Optimistic Growth

I recently asked 15 of our EM fund manager partners in LatAm, S/SE Asia, and Africa about how things were going and what they felt was likely to happen in 2021. Most of them reported their portfolios doing well overall, and most were more optimistic than I would have thought about 2021. Sitting in the US and watching the 2nd or 3rd pandemic wave (depending on who’s counting) starting to wash over us, we could easily think that things are going to go the same way as April in emerging markets, with lock-downs and economic devastation. But that’s just not the case. The one thing everyone learned was that the economic devastation in those markets was much worse than the increase in death rates. For still-to-be-fully-explained reasons, case fatality is notably lower, despite lesser standards in medical care. And there is zero political will to do large-scale lock-downs like we are seeing in Europe and the USA. So business continues pretty much as usual.

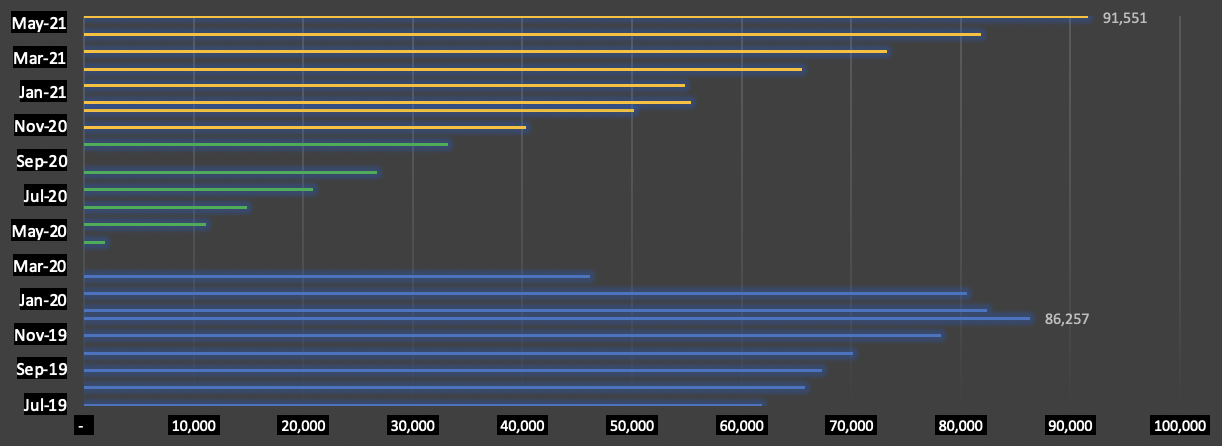

To illustrate the recovery of consumer activity in emerging markets, here’s a graph of KPIs of a mobility company whose business went all the way to zero during lockdown in April. They had enjoyed continuous growth (the blue lines) until March, and now they are bouncing back, already exceeding one-third of pre-covid levels (the green lines) and have forecasted (in yellow) complete recovery with more profitability in about a year from their near-death lockdown experience.

Stepping up a level, here’s what 19 of our global partners think that 2021 has in store for their portfolios. You can see that more than half expect a substantial or ordinary growth year, and only 10% foresee some portfolio failures in 2021. Fund managers in emerging markets are an optimistic lot by nature, but these are folks who get paid to take appropriate risks and are highly incentivized to deliver good returns – they are a decent barometer of what’s likely to be ahead of us in these markets.

Building More Resilient Portfolios

I first wrote about the importance of resilient portfolios almost exactly 2 years ago. At the time, I was thinking about resilience in the context of the end of the longest business growth cycle in history, not about pandemics. But here we are. Going forward, how should we all integrate resilience into our strategies? Those fortunate enough to have large positions in eCommerce or digital conferencing or b2b productivity companies have had an easy time in the pandemic; the opposite of the experience of fund managers I know who have substantial exposures to hospitality, travel, and entertainment businesses in emerging markets — they are suffering mightily.

Two years ago I would have said that eCommerce is likely to slow down notably in an economic downturn, but that affordable private schools would do just fine. The opposite happened in the pandemic. We now analyze and score companies on two dimensions with respect to resilience: pandemic and local recession. There are some sectors that stand out as being largely resilient to both: edtech, healthcare, logistics, agtech, essential food, and insurtech.

Naturally, we’re especially attracted to those sectors. We have been believers in the importance of building resilient portfolios from the get-go, and we are even more so now. Has your investment thesis changed or been fine-tuned in light of both pandemic and rescission risks? Please do reply and tell me – I think this is a theme that will accelerate dramatically in 2021 and beyond.

Naturally, we’re especially attracted to those sectors. We have been believers in the importance of building resilient portfolios from the get-go, and we are even more so now. Has your investment thesis changed or been fine-tuned in light of both pandemic and rescission risks? Please do reply and tell me – I think this is a theme that will accelerate dramatically in 2021 and beyond.

I hope you also saw my last update discussing the deceiving “V-Shaped Recovery“.

Stay home and stay safe. I’m looking forward to starting 2021 with a vaccine and a more hopeful path ahead.