Following up on my comments on headwinds from three directions last quarter, I have two dismal topics, and one uplifting topic to discuss: 1. our recent survey confirms that the well-publicized VC slowdown is in the emerging Global South in addition to the North, 2. inflation risks in the USA are greater than many think, and 3. we had a profitable early exit earlier this month that is a sign of more to come.

Views from 16 VC investors in the Global South: There is no shortage of articles chronicling the slowdown in VC investing, including the deflation of late stage valuations in the venture hotspots of the USA and Europe. With shrewd investors like Ray Dalio making a $10B bet against European public equities and Tiger Global, Softbank and other global private market investors dramatically slowing their investing, we wanted to get some data from VC investors on the ground across the Global South. We surveyed our 16 investing partners in LatAm, Africa, India and SE Asia, who collectively manage more than USD 1,000,000,000 in early-stage VC investments. We asked them about investing velocity, valuation, and their outlook for the next year. Here’s a summary of what we found.

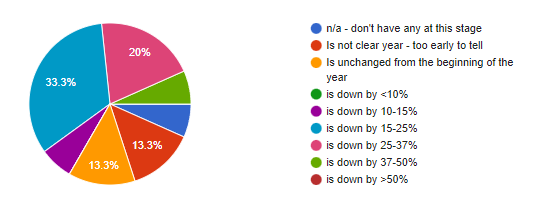

- Velocity at pre-seed and seed has slowed only a little, but later stage has slowed considerably, with investment rounds trending towards taking 3-6 months longer to close.

- Valuations are coming down, slowly (as is typical during VC slow-downs). Earlier stage deals are pricing an average of 15-20% lower; later stage deals are pricing 30+% lower.

- Competition for the best deals are expected to remain strong well into 2023, although nearly all firms believe today’s more-sane pace of investing will continue for at least one year.

- Most founders have internalized the headwinds they face and have taken actions to build cash and stretch their runway, but 25% of our partners feel many founders need to work harder to embrace the slowdown.

My take: despite World Bank and others warning of risks of 70’s style stagflation, the massive influx of VC funding in 2021, double that of 2020, has set the stage for continued investing as fund managers deploy capital while their fund clocks tick along. With GDP growth slowing by half in developed economies and emerging economies taking a hit as well, we and other seasoned investors nonetheless see continued bright spots of opportunity in consumption-driven economies that have been shown to grow despite the macroeconomic slowdowns.

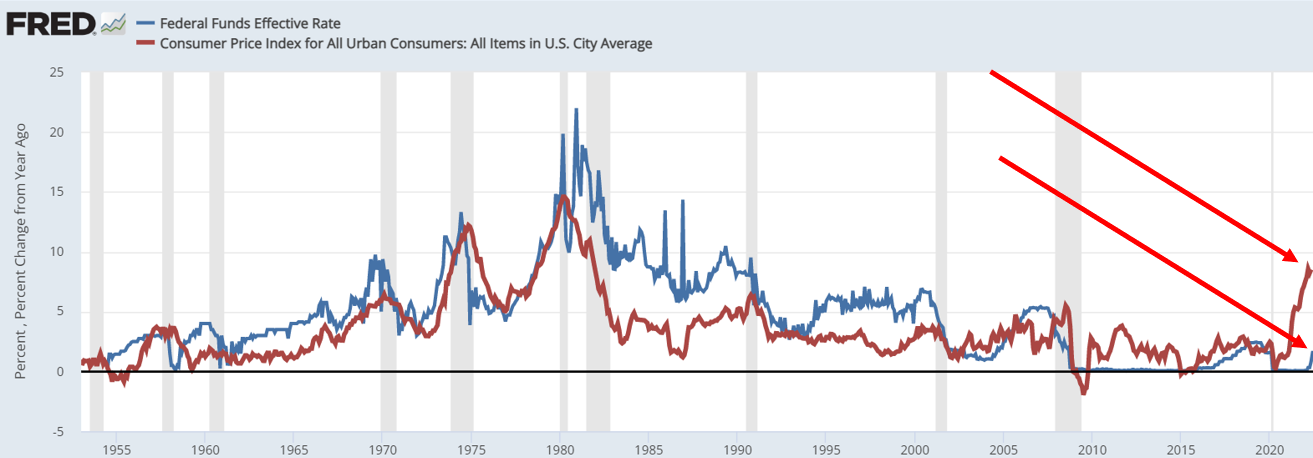

US inflation is bad, and could well be much worse. I’m not an economist, but I know some smart ones, including my father who was known as an inflation hawk during his decade-long tenure as a Federal Reserve bank president and voting member of the FOMC. In my discussion with him, he pointed to this simple chart which tells a scary story: in no time in the past ~70 years has the Federal Funds rate been so far below inflation as measured by the Consumer Price Index. Some Fed experts say that inflation is “transitory” — if so, that would be just fine. But gambling on it being transitory given the headwinds we face seems risky. And if not transitory, getting the inflation genie back in the bottle will take a long time with clear recessionary costs to the US economy and to those that are deeply linked. Ray Dalio’s bet against European equities noted above becomes more clear…

My take: finding profitable growth in the US and developed markets is going to be a challenge for quite some time, and it will get even harder as corporate profits slip with the inevitable reductions in consumer spending. It could take 18-36 months or longer for corporate performance to improve and for equity markets to begin trending back up. Companies in emerging markets that depend on exports to the US and Europe will also suffer. As noted in my 2018 post on the resilience of consumption economies, there will be headwinds for sure in the Global South. We at Capria believe that the opportunity to find profitable tech-fueled consumption-serving companies will persist, likely at even better valuations.

Ending on a happy note – good companies get acquired! About 9 months ago, our partner Angel Ventures recommended an investment in a scrappy and impactful company, Urbvan, that was making transportation safe and productive for urban (especially female) commuters across Latin America. Urbvan nimbly weathered the pandemic and were growing fast, with good prospects. And then they were made an offer they couldn’t refuse, resulting in a merger with Swvl Holdings (see story here) which was rapidly expanding their global network of similar services, fueled by a SPAC in late 2021. The merger gave Urbvan investors partial liquidity plus a big upward potential on the remaining investment! We send a big “Felicidades” to Urbvan co-founders Renato Picard, Joao Matos Albino and their team. With a multi-tranche acquisition via shares of a publicly-held company, the return to Capria is hard to precisely forecast, but we’re looking at an IRR of 60-100%, which is a great first exit of our still-young Capria Fund.

My take: Cash is always king; it’s doubly-so when fundraising velocity slows, valuations drop, and those with cash are looking to apply it to inorganic growth to satisfy investor expectations. We ran a workshop with portfolio company founders in June; about half of them were either actively pursuing acquisitions and/or had been approached for the same. Companies with solid unit economics and the ability to improve the EBIT of a consolidated bottom line will be strong merger candidates, delivering nice returns to founders, employees, and investors. Those without good fundamentals that are running out of cash will be acqui-hires at best. This is why we began back in March to urge management teams and their investors to work toward building cash to a 24 -month potential runway position. This funding pullback could last a while.