Many investors forget that new fund management teams are also startup firms; we need to approach them with frameworks similar to other fast-growth, lean startups

There is a huge opportunity for investing in entrepreneurs in emerging markets. A key missing ingredient is the lack of organized early- and growth-stage risk capital managed by locally-based fund managers. Based on innovative models developed by pioneers such as Unitus, 500 Startups and Grofin, there is now potential for many more local funds to be launched over the next decade, addressing the global “missing middle” (risk capital of typically less then $1 million.)

As we’ve interacted with over 100 aspiring emerging market fund manager teams (and many LPs) over the past 12 months via Capria Accelerator, we’ve gained new insights into expectations that LPs have about fund managers. We’ve also learned a lot about how fund managers think by reviewing their fund strategies, fund models, and operating budgets.

Below are a few of our general observations on new fund managers:

- They are under-capitalized for the difficult tasks ahead of them

- They are planning to raise a larger fund than the market is ready for

- They start trying to raise money before they are really ready

- They greatly underestimate the amount of time required to fundraise

- They burn too much money upfront on professional advisors (particularly legal)

- They underestimate the size of team that they will need to operate a fund well

- They propose cash comp and operating expenses typical of more established firms

- They don’t think through how they are going to build a “brand”, not just a fund

Some of the issues above can be attributed to optimism or a lack of experience. However, we’ve noticed that other challenges are the result of overall market dynamics that encourage impractical plans and make it harder for aspiring fund managers to succeed. We need a new way to think about funding and supporting emerging fund managers inspired by the way traditional venture capitalists think about investing in start-ups.

Some LPs are pushing managers to raise too much capital for their first fund

We see many fund proposals where teams are trying to raise more money than we think is feasible. What’s interesting is that some of the particularly enthusiastic LPs are pushing new fund management teams to “start big” with $75m-$100m funds for emerging markets. Why? Because they want the fund managers to have enough revenue (fees) committed from day one to operate with full capacity for 10+ years managing the fund. An example of this was a fund manager from southern Africa who applied to the first Cohort of Capria in October with a $20m but by February was targeting $200m because her fund advisor, peers and LPs gave her the impression she would be more successful fundraising if she had a higher assets under managment (AUM).

The problem with this logic is that unless an LP is willing to put in all the money (I’ve not yet met one who is), then the fund manager has to figure out how to convince a bunch of other LPs that despite very limited fund management track record that they too should bet big on Fund 1.

I talked with one LP who told me that they, along with a few other LPs, agreed to invest ~$18m in a new African fund management team. Then another (big) LP got involved requiring that the team raise closer to $50m. The fund manager bought in to the story and then spent 2+ more years fundraising for this additional money. And since they couldn’t get LPs to allow them to start investing with less capital committed, they didn’t start making investments until final close more than 2 years later! The first LP told me that, in hindsight, they should have discouraged the higher target fund raise and instead should have told the fund management team to start investing their capital and building a track record. Then the team could raise more capital in a few years … much more easily. And this is still a positive story; most teams aren’t able to get a large fund 1 raised!

Would you fund a startup initially with a Series B round?

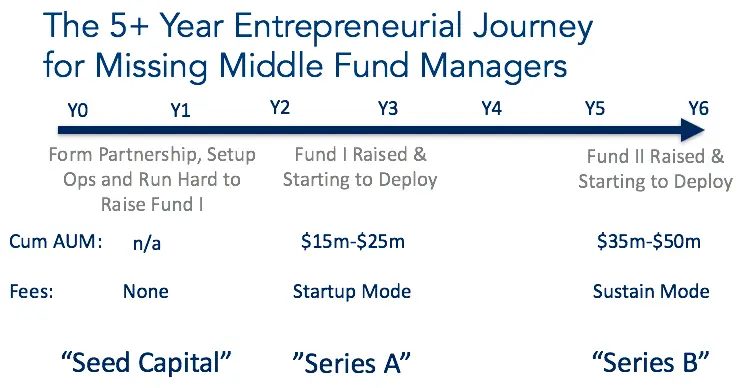

In the venture-backed startup world, investors generally invest in incremental rounds of funding as the company demonstrates traction. This capital comes in the form of funding for 12–24 months of “runway” in rounds called Seed, Series A, Series B, etc. For a fund manager, targeting a $50m+ first fund is the equivalent of asking LPs to provide Series B funding from the get-go. While extraordinary funding does occasionally happen in the startup world, it is extremely rare and only done with successful serial entrepreneurs.

We believe a more appropriate way to look at funding for new fund management teams is to think of them as startups, which they actually are. What that means practically is investors (or the team) provide startup capital to develop their plan and to do their first few “pilot” investments (i.e. “Seed round”). Then the team raises an initial fund … say in the range of $15m-$25m … to demonstrate that they can execute their investment strategy well (i.e. “Series A round”). Next, if they’ve invested well, in 3–4 years, they will raise a second fund … say in the range of $25m-$40m … to build on their track record with the refinements and learnings acquired (i.e. “Series B round”). An example of this is the Oasis Fund in Ghana. The team started by managing an $11m fund for a few years and has been able to engage with more sophisticated international investors as they target raising a larger fund.

With $35m-$50m of assets under management, we believe that most emerging market fund managers should be on a path to sustainable operations. They will eventually need to raise new capital to invest, but they will have enough revenue from fees to sustain their operations.

How can you sustain operations on AUM of only $40m-$50m?

New fund managers can operate with less than $50m of assets under management (AUM) by operating like a startup. Startup founders invest both their own money and sweat equity because they believe in what they are doing. If they are successful, then they create a business that will provide long-term compensation to them. In the case of a fund manager, that compensation is a share in the profits of your funds. For example, we’ve spoken to a number of impressive teams who sold property or other assets to cover GP commits or make their first investments because they truly believed they were going to succeed.

Startup fund managers should expect to take very little — or preferably zero — compensation until the first close of their first fund.

Between first close and final close, they should take nominal compensation. Thereafter they should expect and plan for significantly below market compensation. After they raise their fund 2, then they can take incrementally more cash comp, but it will still be below market rate for private equity. This demonstrates an alignment of interests between fund managers and investors. Both are forgoing short-term gains with the goal of benefiting from significant profits 10–15 years in the future. We understand fund managers have families to support and bills to pay, but no sensible investor would permit a CEO to take a six figure salary until the company had shown some traction. This means fund managers need to have savings, and to be frugal in everything they do.

Fund managers should also set startup-type expense policies — hire team members who want to be in a startup to learn and grow (while being paid less), fly coach, stay in basic hotels, use inexpensive cloud-based digital tools, use service providers very selectively, negotiate hard with vendors, leverage grant/TA capital, make use of low-cost interns, etc. At Capria Ventures, we’ve been operating with this philosophy for 4 years (with < $30m AUM) and are able to deliver world-class quality with a very modest budget. We share our secrets with Capria Accelerator participants.

Why would an LP invest in a $15m-$25m first fund?

Many won’t, but most LPs won’t invest in “fund 1’s” anyway due to the perceived risks outweighing the returns, or due to the “lack of track record”. Also, there is the perception that a fund of this size is “below critical mass” for long-term sustainability — which is often true. Fund management teams need to identify another motivation LPs have to compensate for these inherent risks. Look for LPs who want to learn about the investments you are doing, are looking for dealflow for follow-on direct investing, or have a mandate/allocation which you are addressing. Mandates are easy to start with: LPs are usually fairly transparent about geographic focus, and if they aren’t fund managers, you can look at previous investments an LP has made as a proxy. LPs have to be willing to bet that you will raise a fund 2 bringing you to the point of sustainability, or risk that you might have insufficient fees to keep you focused on managing fund 1 investments to maximize their returns.

Who provides the “startup capital” for new fund teams?

Not many investors. Usually it is provided by the fund founders or friends and family of the founders (aka angel investors). There are a few institutional investors that provide this “seeding” or “sponsorship” capital, but it’s mostly done in the PE world (much less in VC world) by firms where team members are spinning out to start their own venture. Investisseurs & Partenaires (I&P), a Paris-based investment firm, provides sponsorship to new funds being setup in certain parts of Africa — predominantly in French-speaking countries. Capria Accelerator (our firm) provides sponsorship to new fund management teams across the globe — primarily in emerging markets. In addition to capital, both I&P and Capria provide significant hands-on support and access to networks to help fund managers get to market more quickly and make fewer rookie mistakes.

CONCLUSION: NEW FUND MANAGERS ARE STARTUPS TOO

We need to shift our thinking of funding for new fund management firms towards the startup paradigm. This means capital coming in tranches and managers operating on lean “sweat equity heavy” operating budgets for the first 4-5 years (at least). We also need more investors willing to provide the seed operating financing, and fund 1 capital, taking additional risk in exchange for either financial upside or strategic value. Similar to any entrepreneur, first-time startup fund managers need mentors and advisors who can help them navigate through the fund startup waters in addition to capital. There is a huge opportunity for financial returns and impact through supporting emerging impact fund managers. If we can shift the paradigm, we can unlock millions in new risk capital while improving lives across the globe.

Dave Richards is co-founder and Managing Partner of both Unitus Seed Fund, the leading impact venture fund in India and Capria Accelerator, the first global business accelerator for impact fund managers. His funds’ LPs include Bill Gates, Vinod Khosla, T.V. Mohandas Pai, Hemendra Kothari, Diane Isenberg (Ceniarth), and Jim Sorenson. More info http://usf.vc and https://2021.capria.vc

This article was originally published on Medium.