Indonesia’s peer-to-peer lending sector, which has seen several prominent firms plunging into a crisis in recent times, has turned retail lenders and investors wary of the model that is now being put to the test.

The crisis that hit major players – Investree, TaniFund and iGrow – is likely to drag individual lenders away from the platform, leaving only institutional players to operate in the country’s vast P2P lending landscape, according to multiple market observers.

The recent instances of collapse, which impacted dozens of lenders and involved billions of rupiah of financing, could destroy market confidence in the industry for retail investors who have limited ability to deploy capital, they added.

“While institutional lenders can pursue a legal approach to solve any issues with P2P lenders, retail lenders don’t have the same avenues,” said Nailul Huda, an analyst at the Institute for Economics and Finance.

Retail lenders account for 92.5% of total lenders in the P2P lending industry as of Nov 2023, according to Indonesia’s financial market regulator OJK data. However, retail lenders only contributed 11.75% of total financing in the P2P lending industry. Institutional investors such as banks, multi-finance entities, pension funds, insurance firms, microfinance firms, and others contributed the rest of the financing.

If retail lenders push the exit button, then the P2P lending industry will become similar to multi-finance, which disburses financing from financial institutions to customers, Huda noted.

Accumulated funding provided by P2P lenders reached 739 trillion rupiah ($47 billion) as of Nov 2023, nearly 50% higher compared to 494 trillion ($31.5 billion) as of Nov 2022, per OJK data.

Protection to lenders

Customer protection in the P2P lending industry should cover both borrowers and individual lenders, market experts pointed out.

Take the case of Rizky Bunai (32), an officer in the Jakarta area, who faced a lot of difficulty in sourcing information and verifying the credibility of startups.

“I got information about investing in startups from my friend, in short, it was only word of mouth. I was not aware that a [P2P lending] platform should be legal, have a licence [to operate] from OJK, and other such criteria,” he told DealStreetAsia.

After taking a hit on his investments, Rizky urges platforms, regulators, and other ecosystem players to build awareness of the P2P lending model. “The necessity to have a special institution to protect their investment is also urgent, looking at how many people are trapped in fraud platforms,” he adds.

Rizky now opts for more traditional options, such as stocks, mutual funds, and bonds.

Indonesia’s regulator recently capped interest rates to protect borrowers from high interest rates and offered protection to lenders through facilitating risk mitigation including funding risk transfer through insurance or collateral mechanisms, analysts said.

However, there is no such regulation to protect retail lenders.

Jeffrey Bahar, chief operating officer of Yamada Consulting & Spire, said “Experienced [individual] lenders typically choose a platform that not only offers a high interest rate but is good in risk management. Therefore, if one platform is in trouble, they can withdraw their investment and switch to another.”

In contrast, new lenders chose P2P lenders only based on the yield rate. It is these types of lenders who need guidelines on safe investing.

According to Bahar, P2P lending platforms must showcase strong credit scoring so that lenders can make well-informed investment choices, contributing to a more secure P2P lending environment.

P2P lending firm Akseleran CEO Ivan Tambunan emphasised the need for an improved risk management system. “The platform has to meticulously choose borrowers, thus eliminating the need to expose their risk to insurance companies or seek alternative funding to mitigate the impact of a high bad debt ratio,” Tambunan told DealStreetAsia.

Akseleran yield rate to lenders is around 10-10.5%, compared to other platforms that claim to offer 14-17%. The low yield rate, according to Tambunan, indicates a lower return risk, and consequently, results in a reduced bad debt ratio.

“We offer customers peace of mind and trustworthiness, not only a high yield rate,” he said.

Some of the measures followed by the P2P lending platform Modalku include risk management, improved account monitoring for early detection of portfolio quality decline and simultaneous collection and credit recovery efforts.

Dave Richards, co-founder and managing partner of Capria Ventures, which has backed P2P lender ALAMI, said that there is a significant opportunity to integrate AI as well as data analysis into risk and fraud management. “In Indonesia, there’s a notable lack of financial literacy, and people struggle to comprehend various loan products and their implications. By enabling individuals to ask questions interactively 24/7 and receive personalised answers and examples, we believe AI can play a crucial role in boosting financial literacy and fostering trust within the organisation,” he said.

Future course

Notwithstanding the problems, Indonesia’s P2P lending sector may see a limited impact on fundraising as investors apply more caution while deploying capital. Even so, the funds managed by P2P lending platforms are quite substantial, making them a long-term compelling bet for risk capital investors.

“There is an impact to fundraising in the short term as investors will be more selective to invest in fintech lending, they will carefully look at the management risk of the platform, the track record, and other factors,” Bahar said.

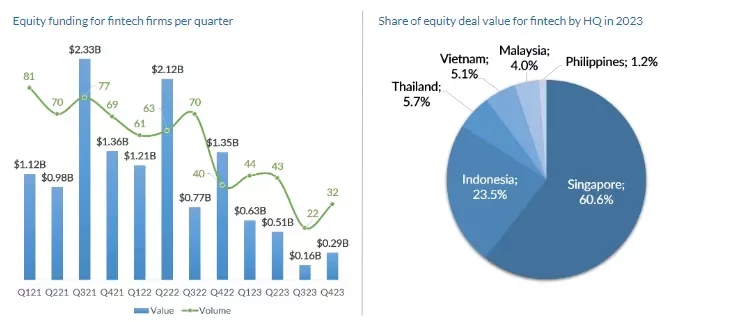

Per DealStreetAsia’s SE Asia Deal Review: Q4 2023, equity investments in fintech startups dropped by 40% to 141 deals, while total capital raised fell 71% to $1.59 billion relative to the previous year. E-payment solutions fetched the most deals last year, but fintech lending bagged the most funding at $503 million, or roughly 32% of the total fintech investments.

Source: SE Asia Deal Review: Q4 2023

The limited funding to fintech, according to Tambunan, has been ongoing since the pandemic and high interest rate era.

The recent cases in P2P lending platforms will not impact the overall business performance of the P2P lending industry.

Akseleran, Tambunan said, will focus on its fundamentals and sustainable growth and not rely on fundraising from investors alone. With this strategy, Akseleran posted a monthly profit in Jan 2024, Tambunan claimed.

In most other markets, P2P lending served as the initial phase for loans, according to Dave Richards of Capria Ventures, which has backed fintech startups including ALAMI. While accompanied by slightly higher interest rates, P2P lending facilitated loans in areas that were unserved by traditional banks.

However, as the market expanded, a noticeable shift away from P2P lending occurred. The challenge lies in the scalability of the P2P concept, involving the effort to gather capital in small amounts from numerous individuals. This trend is observed globally, and Richards predicts a transition towards institutional lending on top of these platforms.

ALAMI, which was historically reliant on P2P lending providers for capital, is now transitioning, holding a bank license and gradually moving towards lending from its balance sheet as a bank, Capria’s Richards said. “This transformation is expected to persist in the market, requiring players who exclusively relied on P2P lending to make necessary adjustments,” he noted.