Following up on my comments last quarter, the velocity of emerging market venture transactions have adjusted to what one might say is a corrected and sane pace – but the best deals are still commanding similar revenue multiples at the early-stage. More on that via our view from the field, below. Starting closer to my home: CB Insights just released their Q3 Valuation Report (based on a predominantly US-based dataset) in which they note

“Median tech company valuations declined across most stages as investors continued to limit their risk exposure in Q3’22. Deal volume was equally stark, falling by more than 20% QoQ across most stages, indicating that investors remain cautious”.

Looking at the public markets which are pulling the late stage privates down, it’s fair to say that nearly every tech investor on the planet has been deeply focused on the price routing of recently IPOd as well as established NASDAQ stocks. This sentiment is inclusive and relevant for previous high-fliers in emerging markets, including MercadoLibre (MELI), Sea Ltd. (SE), Coupang (CPNG) and Naspers (NPSNY), whose combined loss of USD in market value (losses of 27%, 82%, 27%, and 15%, respectively as of mid-November) demonstrates the steeper valuation compressions in international public firms.

The public markets’ harsh judgment has been applied to late stage valuations in private markets since approximately Jan 2022. VCs holding late growth-stage positions in private companies have started taking significant mark-downs as well, as evidenced by Softbank reporting a loss of $26bn in FY2022 in their $150bn Vision fund I and II, and Tiger reporting a loss of $22bn for their venture unit. The list goes on. Hopefully nobody disagrees on the aforementioned points. Judgment of the markets is clear.

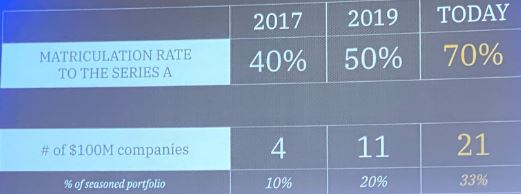

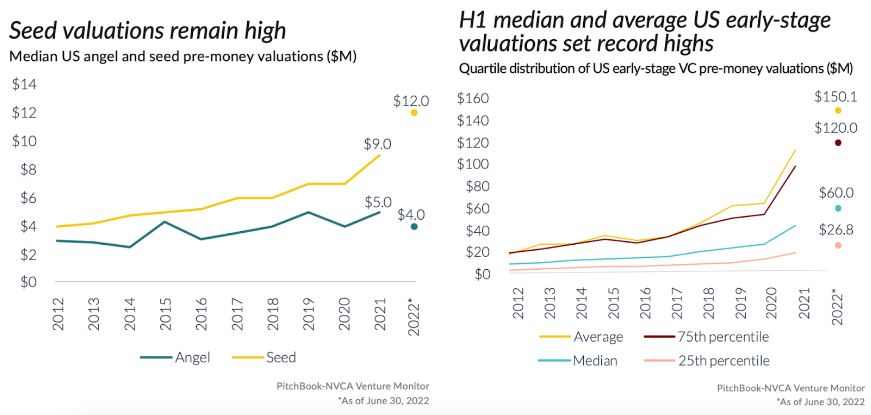

At the other end of the startup lifecycle, things are going better. CB Insights shows median US seed/angel valuations to be down 10% vs. Q2, but up 30% vs. 2021. I recently attended the RAISE GP/LP conference in San Francisco where dozens of largely-Silicon-Valley-based VC presented breathtakingly-good success rates on recent vintage early-stage US VC funds. Here’s an example of a pre-seed investor showing their ability to pick $100M+ value companies over the past 5 years:

The question is, are these early-stage valuations and success rates sustainable? Are the prices being paid for these early stage companies going to hold, or is the correction from late-growth and public markets going to make its way down the VC food chain? I recently wrote an article published in Forbes India on this topic, specifically looking at the previously red-hot Indian IPO market. We thought it would be useful to understand investor sentiment around the world, so I tapped Capria partners to bring in examples from the other tech-hotspots of the Global South and update my views with that broader perspective. Here’s the result:

Southeast Asia – Dealmaking is holding up relatively well in Southeast Asian countries, where velocity has notably been maintained or grown slightly QoQ. Sentiment among early-stage investors is optimistic, with valuations remaining solid at the Seed and Series A. While we’ve seen broad sectoral valuation descent in somewhat later stages (Series B/C) as in other markets, unicorns continue to be minted heading towards the turn of the year. Companies such as Kredivo, Dana, and Akulaku, all from Indonesia, highlight the pockets of confidence that exist in the region. This last point may further be emphasized by Indonesian equity markets expressing a glass half full attitude, as the Jakarta Stock Exchange Composite Index (JKSE) closed at 7,014 points on November 15, 2022, representing a notable 5.6% increase vs. Q2 ‘22 close.

Africa – While African companies are receiving higher levels of scrutiny regarding their valuation, profitability and unit economics, the continent as a whole experienced a 133% YoY growth in funding between H1 2021 and H1 2022. Despite the increased funding in the continent, there has been a 25% decrease in deal volume when looking at Q3 figures YoY. Companies that have been successful in fundraising have had to reduce their valuation expectations, which we have seen first-hand as we continue to evaluate opportunities in the region alongside our local fund manager partners.

LatAm – Summer is on the horizon in South American countries, but the VC space has cooled down overall. However, similar to other regions, early-stage firms remain strong – seed investment reached USD 792M through the first three quarters of 2022, exceeding the annual record of USD 641M in 2021. Of our underlying portfolio, we have dozens of early-stage companies who report they are reasonably confident of their ability to raise new rounds of funding in the next 3-6 months as valuations hold their ground across sectors (LAVCA reports a 12% increase in median deal valuation at the early-stage QoQ).

Opening the aperture again in the US: Despite the later-stage struggles, PitchBook corroborates our early-stage survey in emerging economies with reports of elevated levels of seed and early-stage valuations in the U.S., with Q3 median pre-monies at $10m and $45m, respectively. While companies experiencing roadblocks to late stage growth and exit, our sentiment leans towards this clearing up over the course of 2023. Patience and healthy balance sheets will remain critical as fundamentals for a buoyant M&A environment come back into focus. JP Morgan provides data to support this, noting significant liquidity on the sidelines — $2.0 trillion of cash on corporate balance sheets in the S&P 500 and another $748.8 billion of US private equity dry powder.

What 20 years of EM investing tells me: You will not be surprised to hear that my outlook for the Global South remains long-term very favorable, and frankly even better than it was a year ago, as the correction has brought badly-needed transitions to more balanced buyer’s markets for the first time in ~3 years. We will certainly gain some breathing room for a period as tourist investors return to their home geographies. Many have coined downturns as times where creativity and innovation thrive; entrepreneurs are forced to focus on real problems and capital efficiency. As the turn of the year approaches, we happily stand prepared to continue supporting our portfolio towards brighter days.

As always, I value feedback – please email me your thoughts, favorable or otherwise!

Will