In the spirit of EOY reflections –I promise that this digression is relevant to the topic of this email, explosive growth in Global South VC — it is worth mentioning that when I wrote my first “V-shaped recovery” post some 15 months ago;

- Capria Fund had only 73 companies in its underlying portfolio and had just finalized its first direct investment in Agrofy, a leading horizontal online marketplace for agri-business in LatAm. Capria Fund II was a distant thought.

Today:

- Capria Fund has 160+ companies in its underlying portfolio and 10 direct early-growth equity investments.

- We’ve kicked off fundraising for Capria Fund II which already holds 2 direct investments in its portfolio via a warehouse facility and is half-way to our first-close goal.

How does Capria’s growth reflect what’s happening in the Global South? Over the past 15 months Capria has doubled the number of companies in its underlying portfolio, increased its network AUM by USD 390M, and has completed a new direct investment every ~6 weeks. I hope you’ll agree that Capria’s investment team (comprised of our extended family of 14 fund managers across the network as well as our own team) deserves a round of e-pplause for their diligence and commitment to sourcing top-quality investment opportunities during, after, and once-again-during a pandemic that has crippled the world economy and taken millions of lives.

For the macro-view on Global South VC investing, global media is taking note:

- Crunchbase; Global Venture Funding Hits All-Time High In First Half Of 2021, With $288B Invested

- The New World Report; Unfazed by the Pandemic, Capria Network Invests USD 92.1 Million in Global South as of 2020, Up by 361%

- The Economist; For vibrant, competitive internet businesses, look to emerging markets

- The Economist; Adventure capitalism

- The Economist; The bright new age of venture capital

- Crunchbase; Monthly Funding Recap: November Smashes Another Record As Financial Services Leads In New Unicorn Creation

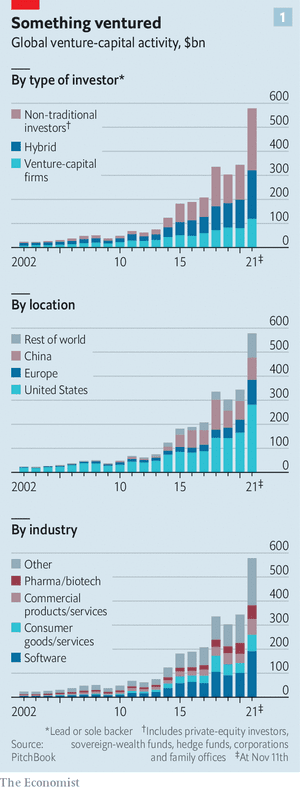

The recurring theme across the board is that global venture-capital activity is heating up and already hit its all time high of $580B for the year 2021, up 50% from 2020, and nearly 20 times that of 2002 levels. Of the 250 new unicorns in H1 of this year, 36% were not headquartered in the US; 9 were in India. Africa has now 11 unicorns, and since the start of the pandemic LATAM minted 26 unicorns. These numbers were unheard of just a few years ago. Capital is clearly able to find opportunity and talent, wherever it originates.

The economist article highlights that Global VC trends are shifting given that VC allocations are not going entirely to global monoliths but instead supporting businesses that can be segmented into three categories:

- Global platforms

- Protected national champions

- Local heroes

Global platforms include your typical giants e.g. Alphabet and Facebook who generate roughly half of all sales outside America. These giants remind us that the success of Silicon Valley continues around the globe, except of course in China.

Protected national champions refer to companies that are a) growing in the protected national markets of China or Russia, and b) facing governments that discourage and sometimes outright limit domestic and/or global expansion that they find threatening. The protected national champions dilemma helps explain why capital is now shying away from China. Allowing other countries in Southeast Asia, Latin America, and Africa to attract investors in their local markets.

“Of the $342B spent on takeovers of emerging-market tech firms so far this year, 71% came from economies outside China, the highest share in 11 years” (5).

So, who are the local heroes? The local heroes are the businesses prevalent across most of the world and the types of businesses that Capria’s investment thesis is structured around. “In Asia and Latin America, local and regional companies often rule in e-commerce, gaming, digital payments, ride-hailing, food delivery and other app-based services” (3).

Local heroes are firms that solve fundamental problems in their local markets and thus require an active local team made up of entrepreneurs capable of absorbing domestic and international capital and applying lessons learned outside the ecosystem in a unique way to solve local problems at massive scale. The Capria Network can be considered a booster for the local heroes because it is a group of like-minded VC partners leading independent investment firms targeting their local and regional markets while engaging deeply with peers across the Network to share learnings, deal-flow, and find synergies for their rapidly growing portfolio companies.

A quick look at Capria’s early growth equity investment portfolio will certainly ring the bells of unsung local heroes in the soonicorn growth-phase.

We have a continuous stream of co-investing opportunities that we bring to our current and future LPs. If you’re interested in access to the up-and-coming local heroes of the Global South, please drop us a note.

A final note on omicron: while we are as concerned as anyone, we are well prepared. To the best of my knowledge, no company in our direct or indirect portfolio of 160+ companies has failed due to covid. Suffered, for sure. But the combination of the resilient businesses they operate and the perseverance of strong entrepreneurs backed by dedicated investors have helped them all make it through the worst delta had to offer. While we all will take appropriate measures, we see no reason our portfolio and the thousands of tech-fueled startups around them will not continue to thrive based on our current knowledge of new variants.