Just shy of a year ago, I sent an email to our global fund manager partners and to our direct portfolio CEOs titled “Only the Decisive Survive”. At that time, not many outside of China were concerned about COVID. However, I was obsessed. Hearing stories from fund manager friends with operations in China, I knew things were worse than what the Chinese press were telling the world. And I live only 5 miles south of the location of the first COVID death in the US. The pandemic was clearly accelerating exponentially, and I wanted to get all of our partners to open their eyes to the risks and prepare as well as they could.

I’m not writing with that level of intensity or urgency this time, but I am concerned, and I’m hoping you will take a few minutes to read my thoughts here and take a few precautionary measures. These are precautionary measures we all need to be taking, not just in light of COVID, but as a general means of ensuring each of our firms can continue to thrive when facing unexpected tragedy. My partner Susana invested in 90 funds over 20 years – she’s seen everything from motorcycle accidents to depression take out fund managers and CEOs. Life works that way sometimes, and it’s not always someone else. It’s the “What happens if I get hit by a bus scenario?”, in this case, the bus happens to be a global pandemic.

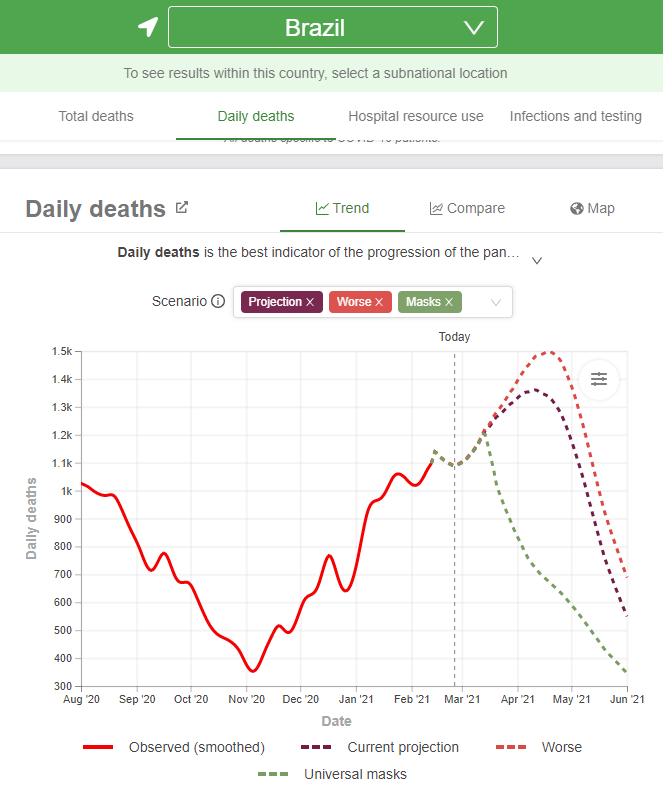

Vaccines are flowing in developed markets, but as you well know, the roll-out is not so fast where we all operate. One of our funds in Asia recently reported COVID cases in 3 CEOs among their 23 companies. Even younger entrepreneurs are not immune to this scourge. And while developed market infections and deaths are trending down, many countries are seeing serious new outbreaks, some quite bad (like Brazil). The pandemic forecasting site IHME predicts a growing caseload across Sub-Saharan Africa and East Asia and Pacific regions. The LAC region is trending down overall, but like Brazil, some countries including Colombia are expected to experience a second (or third) wave of infections.

California (and variants)

Another development we all need to watch is the “California Variant” which, like the South Africa variant and others, is by no means confined to California. This one is clearly more virulent and potentially more fatal, although the jury is out on that. Early reports that you’ve undoubtedly read indicate that most vaccines look to protect against most variants, but there is no conclusive evidence yet; prudence is still very much warranted.

As the Economist said in mid-Feb, “Coronavirus is not done with humanity yet”.

Business continuity planning for your fund

A month or so ago, we were trying to move forward with an investment in a fund in Africa with whom we had been speaking and doing DD for a few months. They went totally radio silent for over 2 weeks. We didn’t know whether to be miffed, concerned for their health, or what. When they finally came back online, we learned that their managing partner had a very bad case of food poisoning that put her in the hospital for 2 weeks, pretty much out of commission. And her team didn’t know how to respond to our emails to her, or how to respond when we reached out to them, so they just went silent. Their investment director now has COVID. This is not good. But it is a good lesson for everyone.

Ask yourself this question:

“What would happen if I or my partner(s) checked into the hospital TOMORROW and had no phone and/or was too sick to call anyone, and that went on for two or three weeks (or longer)?”

If the answer is “I’m really not sure”, then you don’t have a business continuity plan. This does not have to be complicated or long. But it needs to tell you / your senior team how to keep big things moving forward, what things you / they need someone else to take over, what decisions can they make without you, and what decisions need to wait until you/they are back online. You don’t need to address every little detail – you have smart partners and smart people on your team. But you need to address the big topics, like issuing/approving a capital call, or fielding a request from an anchor investor, or ensuring a payroll gets approved, etc. You know what things depend on you and your partners day to day. Write them down, discuss, and then be sure that all partners plus one or two trusted senior team members are familiar with the continuity plan as well. You will sleep better. Your partners will sleep better. Your investors will sleep better.

Business continuity planning for your portfolio

As noted above, entrepreneurs get COVID too. It could take them down for a few days, or two weeks, or in the worst case, forever. The planning described above is equally important for your CEOs, and for them, with their CxO team. The action here is straightforward: in your next check-in, sometime within a week or two, say “We just drafted a business continuity plan (“BCP”) for our firm, ensuring that if any one of us goes out sick for a week or more, or worse yet, dies or is disabled, we can keep the business moving forward and ensure that our team gets paid, partners and customers are engaged, and people can continue working productively day to day. I assume you have something similar for your team. Could you send me a copy?”

Presuming they don’t have anything, here are some concepts you could suggest:

- Establish a “work buddy” — someone who can be depended on to fill in for an absent buddy

- Establish documented “leave cover” — who (one or more people) are known to be able to cover responsibilities when someone is on leave (or sick), and they have the info they need to do so well. This info should be documented in detail, accessible to all that might need it, and updated regularly.

- Think about “DFNO – Design For No Ops”. Wherever possible, design workflow that can be automated, and if not automated, handled by systematized, well-documented processes.

- WFH – the pandemic has already ensured that staff has the ability to work from anywhere if/when required. Are there any problems that come in if person X is working from home and person X and her/his home are not reachable at all?

- Take whatever you’ve done for BCP and test it, to keep staff on toes and ensure you can continuously refine the processes.

- For a small to medium-sized firm, recognize that having multiple responsible partners as signatories is a good thing. Three is a good number for big-ticket decisions, large wire transfers, etc., for if one is out, at least you can still make payments on a “2 to sign” basis.

Testing your business continuity plan

One of our partners in Latin America not only has a BCP — they have actually tested it! How? One of three partners took a one-week offline vacation. He could have been reached, but his partners and his team respected his being offline and looked to move things forward including closing a deal and finalizing an LP report. Making it work required having internal approval processes right, and also getting powers of attorney signed, and ensuring that the two other partners could approve wire transfers. Now they know that any two of them can “keep the trains running” if one is out.

Have you seen any other best practices that I should recommend to the network? Please send them my way and I’ll update into my blog post and send to the network via Slack as well.

Be prepared and stay safe, and let’s all hope this last gasp of the pandemic passes soon.

Featured On