Our collective world has gone through rapid change since we set out on the journey we did 4 years ago, but boy did 2020 keep us on our toes! Our confidence that world-class companies are being built in Africa has entered a new phase as we witness the scale potential of our most successful portfolio companies.

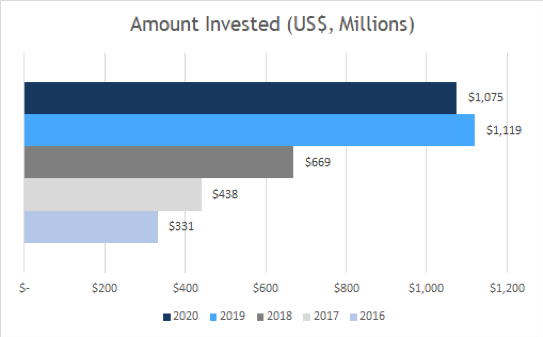

Rewind to 2017 and a handful of small VC funds were trying to establish market validation. As is typical at this time of year, estimates of the amount of venture activity in Africa in 2020 are still rolling out, but the consensus is that over $1bn in VC funding and $1bn in M&A was seen in 2020. Suffice it to say that capital deployment has increased at least 5x since we set out. With the Great Digitization that resulted from the Covid-19 pandemic, frontier markets are better connected digitally than ever. Ideas and capital now meet much faster. Opportunity discovery, the availability of capital, company formation and competition have all advanced rapidly. 2021 arrived with African VC operating at a higher velocity.

At Lateral Capital, we had our busiest year yet with 11 investments made including 7 new portfolio companies (taking the total to 16) and 4 follow-on up rounds. Most importantly, surviving a year of shutdowns, travel limitations, employee health and safety, remote fundraising, diligence and customer interactions across Africa drew us closer than ever to our founders. These challenges demonstrated incredible resolve on the part of our founders and team. In retrospect, 2020 provided a catalyst in testing our investment thesis and portfolio operations. Founders doubled down on culture and a narrow set of key performance indicators around product and traction and have raised the bar in terms of what can be achieved with a financing round.

Network effects mattered more. While we have always prided ourselves in the number of opportunities that we review annually, in 2020 we relied on the endorsement of other founders, our advisors, fellow VCs and customers more than ever to meet and assess companies. With the urgent digitization and ‘remote everything’ adaptation we saw in 2020 in which we all lived on Zoom, Google Meet, WhatsApp and Clubhouse, access to the networks of others through long-term relationships became a proxy for due diligence, business development and value creation. It is crazy to think that 40% of our team has never met, and our 3 co-founders have not met in person in over 12 months…

A summary of the 5-year trend in financing African Tech Startups is as follows:

Source: Baobab Insights and Briter Bridges 2020 African Tech Funding Reports

The Great Acceleration: Covid as a Catalyst

1. The increased access to affordable and high-speed Internet across the continent

2. The role of African startups in transforming the local economic landscape and creating new market opportunities

3. Africa’s commitment to developing the world’s largest single market under the African Continental Free Trade Area