During the last five years, I have been working with the LatAm ecosystem both as an insider and as an outsider. This has provided me with insights about the spectacular evolution of the venture capital ecosystem in the region and how we got to the massive explosion of investments in the first place! To better dimension the opportunity both investors and entrepreneurs are seeing, it is key to get a full picture of what’s happening.

- The region is home to more than 650 million people across 33 countries.

- Brazil and Mexico, have populations of 210 million and 130 million, respectively, and GDPs of US$1.8 trillion and $1.3 trillion.

- Colombia (50+ million people; US$300+ bn GDP), Argentina (45 million people; US$445 bn GDP), and Chile (19 million people; $280 bn GDP).

The Evolution of LatAm’s Ecosystem

The systemic reason why historically there has been limited appetite for investing in the VC industry in LatAm is deeply rooted in its traditional investors. Investors were and still are risk averse. The main sources for capital have been accumulated by family owned-businesses and high net worth individuals (HNWI), which have traditionally gravitated towards cash-flow generative businesses. Today, this challenge continues but as more and more successful start-ups emerge in the regions, newer generations are betting to uncover some serious new investment opportunities.

Before the 2000’s, development banks and government players had to step up to help develop the VC industry. Multilateral institutions such as the Inter-American Development Bank (IDB), took on a strategic role, by establishing the Multilateral Investment Fund (MIF), to start investing in seed/early stage VC back in 1996. The objective was to support first-time fund managers to build a successful track record, and jointly develop a local VC industry for companies without access to conventional financial services. To this day, governments and institutional investors continue to invest as Limited Partners (LPs) and offer funding lines. Some of main stakeholders include CAF, Fondo de Fondos México, BNDES, and StartupChile.

For this piece, I interviewed Susana Garcia-Robles who has played a crucial role helping shape the VC ecosystem in LatAm, being widely accredited as the architect of the LatAm ecosystem as she started working in 1999 at the MIF/IDB Lab three years later after they started investing in VC. Currently she is a Senior Partner at Capria Ventures.

Suad: Can you tell a little of how you got started in the VC ecosystem and what it was like in those early days?

Susana: I started working for the Multilateral Investment Fund “MIF” (today IDB Lab) in 1999, only three years after they began doing VC investments. One of the strategies the MIF had was to prove that equity could be used as a development tool. Through my 20 years+ there, I was privileged to actively see through the approval of investments in 90 seed and VC funds. One of the first lessons I learned was that we needed to build the ecosystems in the countries at the same time than investing, while going to the best countries first (Brazil) and using them as laboratory for experiences and lessons learned, and from there go to other countries less developed.

Suad: How exactly were these efforts channelized?

Susana: I used grants to build ecosystem programs like INOVAR, Colombia capital, Jamaica VC, supported all local VC associations and was involved from the early days at the Latin American Venture Capital Association “LAVCA”, providing a series of financing until the association was sustainable enough. I led the creation of programs like Xcala for angel investor networks, Mas Emprendedoras with Endeavor in Uruguay, (others and myself) supported Endeavor establishment in many countries in LATAM, the acceleration programs for fintech and agtech with NXTP Ventures, and then in Caribbean and Central American countries, invested in the first green funds in the region.

Investing in NXTP was a huge boost to the regional ecosystem, since in their first fund they invested in 198 startups! Through the INOVAR Program with FINEP we channeled $1B to small companies through our funds’ incubator program (we won an OECD award for best program and Josh Lerner from HBS wrote a case on INOVAR).

On the equity side, we were anchor investors putting up to half the size of the funds at the beginning, and then when the industry began to consolidate, we lowered our percentages to 10–20%, securing $ from the private sector. We supported first-time fund managers, and second timers as well, being truly catalytic. Through INOVAR, we got pension funds to invest in VC. So, little by little, fund managers began calling me the godmother of VC in LATAM, and last year I was awarded a recognition by Americas Quarterly as one of 5 Top Leaders promoting women economic empowerment. Moving out of IDB and going into Capria has allowed me to expand all activities to many other EM, like MENA, Africa, India, and SE Asia.

Suad: Although many of these programs are successful, what do you believe was the main challenge they faced? Lack of funding in subsequent rounds? Lack of density in the start-up ecosystem?

Susana: Working with non-profits on the grant side is challenging because after one or two rounds of our grants, others needed to come in and that wasn’t always the case. For example, INOVAR kept going way after our direct involvement, but similar activities of ProCapitales in Peru finished with our last grant, Colombia Capital kept growing and resulted in founding Colcapital and spearheading the Fund of Funds… In some cases, lack of density in the startup ecosystem mad it more challenging as well (Caribbean and Central America, Ecuador, Bolivia, and for obvious reasons, Venezuela), but this is changing.

In the early 2000’s, activity remained limited as both the start-up scene and availability of funds was almost non-existent. Argentina, helped plant the seed for the first generation start-ups when in 1999 both Despegar and Mercado Libre launched. Today, they are widely successful companies that publicly trade in NYSE (DESP) and Nasdaq (MELI) with a market capitalization of US$79.84 bn.

The first big VC firm to set up in the region was Monashees in 2005. Today, it is one of the most successful funds in Latin America and the first Brazilian VC fund to invest regionally. I remember listening carefully to Eric Archer, Founding Partner, speaking at one of the Latin American Private Equity & Venture Capital Association’s (LAVCA) panels in NYC reminiscing about the challenges the fund had to overcome to raise from LPs, while simultaneously struggling to source investable tech companies. Today, this almost sounds absurd, when you look at the density, maturity, and capital deployment levels in Brazil.

So, how did the ecosystem end up expanding its investment rate from US$143m in 2011 to US$4.1bn in 2020?

Over the last decade the tech and venture capital ecosystem in Latin America (LatAm) has gone through an incredible transformation and acceleration, proving resilient to the challenging macroeconomic environment where most economies in LatAm are export and commodity driven. This has proven that the ecosystem can thrive and prosper under challenging contexts. Furthermore, innovation has proven to be vital for the region as it has created more inclusion, economic growth, and employment. Nonetheless, it is crucial to emphasize the innovation and the development of the ecosystem changes in scope from country to country.

Suad: What positive paradigm shifts were occurring at the beginning of the last decade that were setting the grounds for the success we see today?

Susana: Technology adoption and at the same time the gap (not total adoption, connectivity challenges) provided a challenge and an opportunity for tech companies to begin to grow, finding its way providing access to basic services in sectors Must-Haves: finance, education, health, agribusiness, among others.

Since ~2010, I began to see that an unconventional brand of innovation, offering products and services made in Latin America and the Caribbean, was being born; ‘Made in LAC’ is possible thanks to the diversity of its people. What are the secrets of the region’s success?

1. The young and entrepreneurial spirit of its inhabitants. With an average age of less than 30, the millennial attitude of Latin Americans and their receptivity to using new technologies is evident.

2. Internet and smartphone access. By 2019 about 69% of the population uses smartphones and two thirds have Internet access.

3. Great challenges to solve. This region presents great challenges when it comes to access to education, health, finances, decent housing, and clean water. LAC also needs a renewed boost in vital sectors such as mining, agriculture, energy, and transportation. These challenges, rather than problems, are opportunities.

These three ingredients are joined by a large dose of frustrated entrepreneurs who are witnesses to the challenges of their cities and communities. This frustration drives them to create companies that facilitate access to better education, health system, and financing that effectively democratizes access to basic services for all citizens. They seek to create new ways to fertilize the fields and predict natural disasters, to take care of the cleanliness of the oceans, to provide domestic workers access to micro-loans, to improve health for all, and to use telemedicine to serve rural populations.

It is a brand marked by innovation and a clear social and environmental awareness. These new entrepreneurs are interested in both making money and improving the lives of others. No one is better qualified to find a solution than the individuals who live amongst the problems.

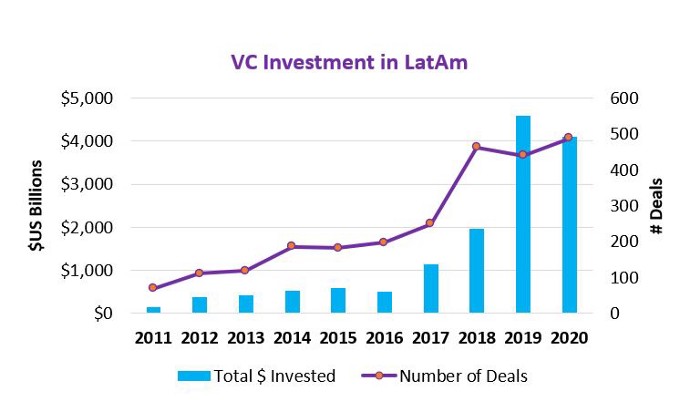

According to Crunchbase news, in 2011 VC investments were estimated at US$143 mm with 69 deals, mainly in Brazil. There was very little interest in other countries in the region, as Brazil’s economy was booming and was the 7th largest economy in the world. Still the venture capital industry was underdeveloped, and entrepreneurs were launching copycat start-ups from the US. The main issues were that startups were not addressing real pain points and capital remained scarce. That year, some of today’s top VC players, like Red Point e.Ventures in Brazil, and Kaszkek in Argentina were founded. The latter backed Nubank at seed stage, a Brazil-based fintech, that in 2014 became Sequoia Capital’s first investment in the region.

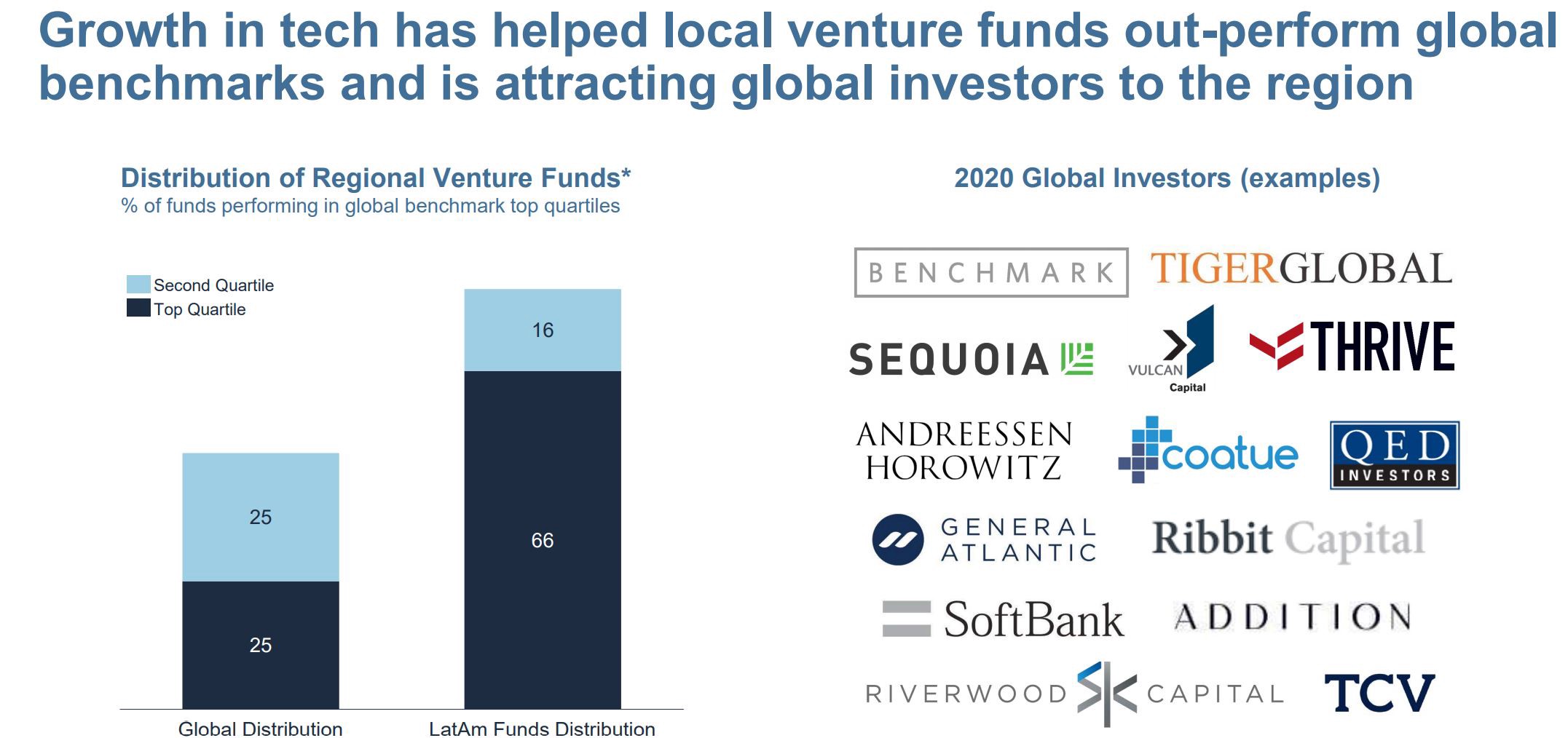

The emergence of new technology hubs was supported by previous success stories from sophisticated ecosystems from major markets like Brazil, Argentina, and later Mexico. By 2016, LAVCA, reported a record investment in LatAm of US$500 mm, as top-tier global and corporate investors started making commitments to start-ups in the major markets. Partly this advancement was supported by a growing number of highly qualified human capital that had a combination of the right skill set, including grit, business know-how, and a world-class vision.

Simultaneously, they became obsessed with delivering solutions that addressed massive pain points in society, while creating substantial value for their shareholders. As companies’ maturity increased, global investment started to flow in the region, creating an exceptional effect in LatAm, as it benefited from better funded rounds, new co-investment partners, follow-on investments, the explosion of technological disruption, and an increased appetite for high-risk investments. As a sign of the times, Andreessen Horowitz’ decided to enter LatAm by funding Rappi, a Colombian last-mile delivery platform around this time.

By 2017, as success cases continued to pop up, local and global player’s risk aversion declined pushing investments in VC regionally to a staggering US$1.14bn. Some of the achievements that helped propel the growth, according to Julie Ruvolo, Director of Venture Capital at LAVCA, are mainly linked to the US$200M investment round of Brazilian rideshare company 99, and later their acquisition by Didi Chuxing at a valuation of US$1 bn. “The success that founders and team of 99 have achieved in Brazil embody the very spirit of entrepreneurship and innovation in the LatAm region,” said Chen Wei, Founder and CEO of DiDi, in a statement.

Another extraordinary year for the region was 2018, as investments amounted US$1.98 bn. showcasing the maturity of the market and the validation from international investors of the ecosystem. In that year Monashees raised its fifth fund for US$150 mm. iFood, a Brazilian food delivery application, raised US$500 mm from international funds. Additionally, lofty investments from Asian funds, like Tencents investment in Nubank, AntFinancial into StoneCo, and Softbank’s investments in Loggi, Gympass, and Rappi started to propel more readily available capital for later stage companies in the region. Finally, international VCs started to notice LatAm’s untapped potential in the VC ecosystem, giving chance to spur rapid growth and market positioning of companies. In the past, smaller sized VC funds and limited scaling know-how in many instances limited their portfolios capabilities to scale internally and pan-regionally.

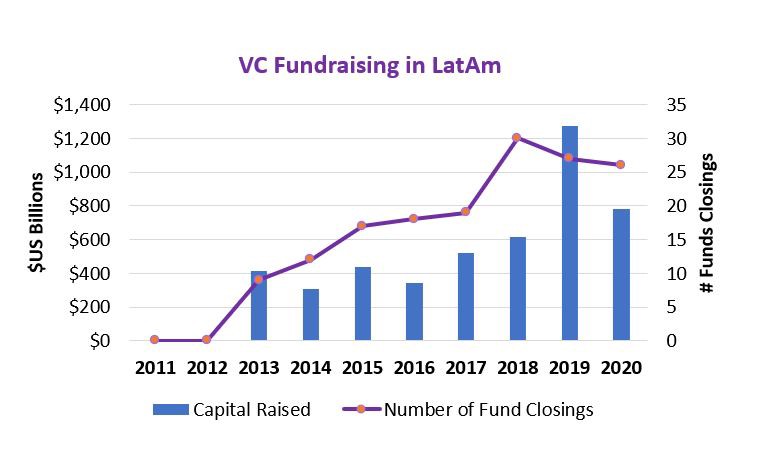

Investment hit a record in Latin America in 2019, as local funds as well as international funds from Asia, Europe and North America invested a combined US$4.6bn. International investment skyrocketed in part due to SoftBanks US$5 bn fund for the region and completed a US$1 bn investment in Rappi. This breakthrough, finally put on the map companies from countries like Chile, Colombia, and Peru.

As Mary Ann Azevedo from Crunchbase News explains:

“In terms of fundraising, 2019 was a record year in Latin America. About $1.8 billion was raised across 28 investment vehicles, compared to $670 million across 30 vehicles, in 2018.”

Additionally, Kaszek Ventures raised a staggering $600 million across two new funds, including $375 million for its fourth flagship fund and $225 million for its first opportunities fund. Julie Ruvolo also pointed out that a new phenomenon in the region has been the rise of venture debt and alternative investments, crucial for the fintech sector.

Suad: What is the role of regional and international funds? Why is it key, especially in countries like Colombia, Peru, and Ecuador?

Susana: Local funds struggle to reach critical mass and although they are the best positioned to support the entrepreneurs specially in the earlier stages, many do not have enough capital to allocate in several financing rounds. That’s where we’re seeing international funds (Tiger, 500Startups, Softbank, Bessemer, GE Capital, Flourish, Greycroft, Quona, QED, Rakuten, Bain and many others), or larger players like Kaszek, Monashees, Valor and Redpoint come in and take the best companies. We’re also seeing that in many cases international funds are getting into LATAM companies that were not being funded by locals (Rappi being the most obvious case, NotCo an interesting case of being funded by a PE fund), perhaps because of the issues raised above in your article.

Key to grow the industry in Peru and Colombia is to have the big family offices, pension funds and insurance companies allocate a portion to venture capital. The industry will have an incredible growth in those countries if pension funds and insurance companies would allocate even a minimum of 1–2% of AUM to venture capital.

According to Crunchbase News, co-investments between global and Latin American investors increased. 37% of the total US$4.6 bn VC dollars were deployed via a co-investment involving at least one Latin American investor and one global investor. The latter are crucial for later stage start-ups that aim to raise from a Series A onwards.

A further important new dynamic in the market, has been fueled by successful entrepreneurs like David Velez, CEO and Co-founder for Nubank, Florian Hagenbuch from Loft, and Andres and Daniel Bilbao from Rappi and Truora, who are pouring money back into while making rounds more competitive for funds.

The battle through 2020

According to the World Bank, Latin America suffered more economic damage from Covid-19 than any other region in the world. It is estimated that the GDP contracted by 6.7% in 2020 (excluding Venezuela). This not only affected entrepreneurs, but also funds who were affecting on their funds closing and fundraising targets.

Nonetheless, amid the pandemic, venture investments took off in the second half of the year as internet adoption augmented and e-commerce grew at 33%, the fastest rate in the world, investors, especially international funds decided to reactivate their investments.

Andrew Tsao from Silicon Valley Bank explains:

“given that the movement to digital is earlier in the curve than in developed markets, the acceleration is even more pronounced.”

According to LAVCA’s latest report start-ups captured US$4.1B across a record of 488 deals, making 2020 the second-best year on record for VC deals. Fintech, e-commerce platforms and marketplaces, and proptech were the lead sectors to attract capital receiving US$1.6B, US$414M, and US$275M.

Covid’s high digitalization adoption rates continued fueling the digital acceleration in the region. This led to the appearance of Uruguay’s first unicorn, dLocal, a cross-border payment processor that connects global merchants to emerging markets. Also, Brazilian proptech Loft received US$175M topping a valuation of over US$1B. Online lender Creditas raised US$255M, boosting its valuation to US$1.75B year and Rappi raised US$300 million reaching a valuation of US$3.5 bn.

Why FinTech is key?

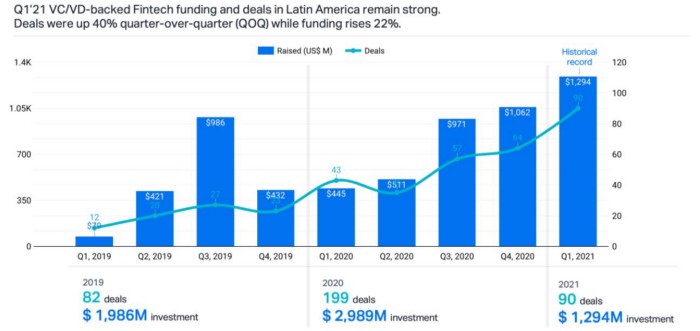

There has been a rampant investment in FinTech amid the pandemic, furthering propelling the digitalization and further investment to the region.

There are spectacular opportunities in the industry as:

- Legacy financial institutions cater mainly to the wealthy at high prices

- “Challenger banks are finally creating a level of competition in the market that is really healthy for consumers,” said Bill Cilluffo, a partner at QED Investors.

- Lack of customer experience and limited product offerings from legacy financial institutions

- Small businesses and micro entrepreneurs are overlooked

Over 40 million people in the region were added to the banking ecosystem over five months during 2020, according to research released in October by Americas Market Intelligence in partnership with Mastercard.

Have we seen change in 2021?

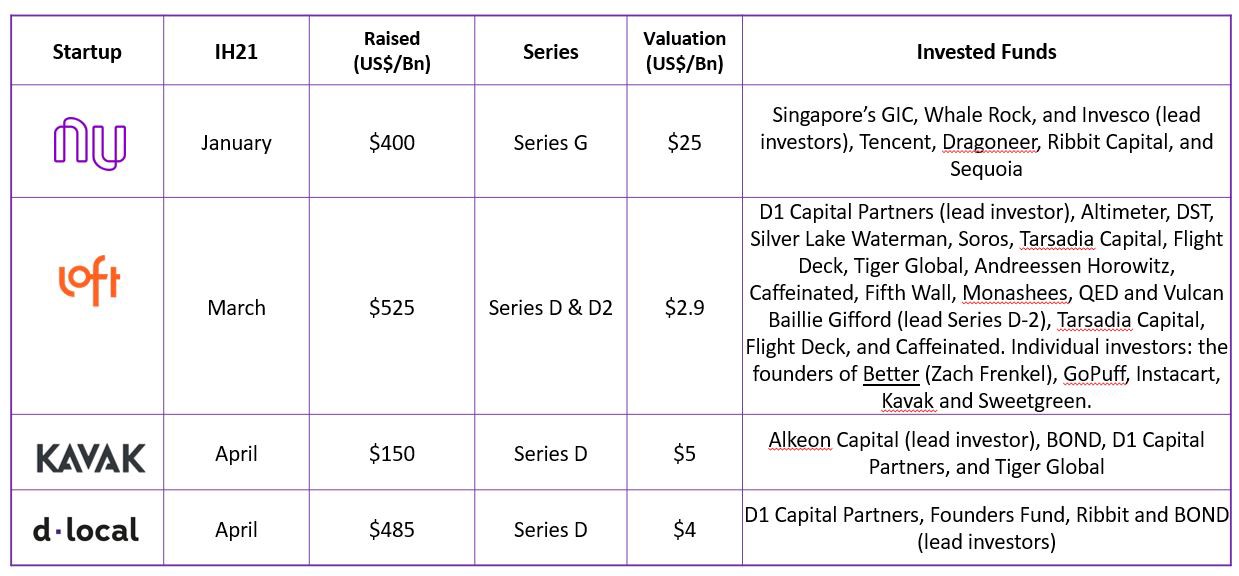

This year started as an extremely active and exciting year for the region, as we have seen an explosion in mega rounds! As of January Nubank became the largest neobank in the world, reaching a staggering valuation of US$25 bn, after raising US$400 mm in January. Recently, Reuters announced that Nubank might have initiated preparations for a U.S. stock market listing. I am pretty sure, all the world will be following closely this news!

I really love the fact that we have continued to see more mega-rounds that continue to attract top notch capital from around the world. Companies such as Loft, recently raised US$425 mm for a Series D and then an additional US$100 mm in an extension to that round, reaching a US$2.9 bn valuation. Additionally, dLocal raised in April US$150 mm reaching a mind blowing valuation of US$5 bn, making it one of Latin American’s highest-valued start-ups. Finally, Kavak, raised US$485, reaching an extraordinary valuation of US$ 4 bn! It is important to highlight that ALL of these rounds have been led by international investors, proving support and validation for earlier stage investors. I strongly believe, this year, we will most definitely break any previous investment records in LatAm.

Success Stories

Latin’s America is a story of resiliency, as entrepreneurs have struggled not only to build their companies but also to become great at the art of fundraising. However, as the Latin American entrepreneurial environment has become more and more sophisticated, entrepreneurs have developed social networks at high velocity where geographic limitations have become blurred. This is key, as it has allowed for pre-seed and seed investments to thrive pan-regionally. Even more crucial, has been the creation of networks throughout the region, increasing funding across geographies.

As success cases become more evident to investors, start-ups strategies include more and more a multi-country presence. This is especially important for countries like Colombia, Argentina, Chile, and Peru. As more funds are pouring in more resources, entrepreneurs have been capable of building robust companies that make industries more competitive and incentivizing disruption in various sectors. Angel investors have become great co-investors for funds. One of the best examples is GE32, a fund created by founders Florian and Mate, who launched Loft with the philosophy, “Takes one to know one.”

Suad: What are the biggest successes you have seen in the VC ecosystem? What do you continue seeing as crucial for these successes to continue? What is yet NOT happening that could even speed up more the current successes?

Susana: More than successes, I’ve noticed progress on the following, although still there is a lot more to work on to claim a success:

Progress: Incorporating more women as CEO and fund managers as well as investing in gender-diversified startups. Unfortunately, it’s slow work all around the world, but things are getting better. WeXchange, WISE and many other initiatives started around 2010+ were able to showcase successes by women STEMpreneurs beyond seed capital. WeInvest is a community for women investors in LATAM that has 155 members, and there is country focused similar communities in Mexico, Colombia, Peru and Brazil.

Crucial to keep improving: go beyond including more women but tackle the issue of race: afro descendants and from indigenous descent are being untapped not only in Brazil, but also in Chile, Peru, Mexico, etc. Leila Velez from Beleza Natural is an excellent example of a CEO of a great company who not only is afro descendant but lived in a favela in Brazil.

Address the financing gap, which has moved from pre-series A to series A. There’s a growing number of accelerators, angel networks and seed funds, but there’s a gap between the tickets they provide and what growth funds provide: 5 MM+. We need more funds investing in the range of $500K-5MM. But we also need more local funds with good capitalizations like Monashees, Redpoint, Valor and Kaszek to keep supporting the scaling up of the local unicorns and soonicorns.

Clear Progress: Companies are raising money faster, at better valuations and beyond series A, there is overseas interest in LATAM beyond Brazil.

Progress and Crucial to Keep Improving: Collaborating on building the ecosystem. This is not only the task of multilaterals and governments but also of corporates, investors, Vc associations, foundations, etc.

Crucial to keep improving: Cultural shift on continuing to break down the fear to fail! Not that we should adopt the frenzied Silicon Valley “Fail Fast, Fail Often”, but let’s change our mindset: a failure doesn’t make you a failure. If you learn from your failures, you have acquired a unique experience that will help you do better the next time around.

Not yet happening at a good speed: a good critical mass of entrepreneurs that become serial entrepreneurs (like Wences Casares), then angel investors, mentors, and some become fund managers (Hernan Kazah with Kaszek, Ariel Arrieta from NXTP). We have a few examples, and they are all male. Women are still catching up on this.

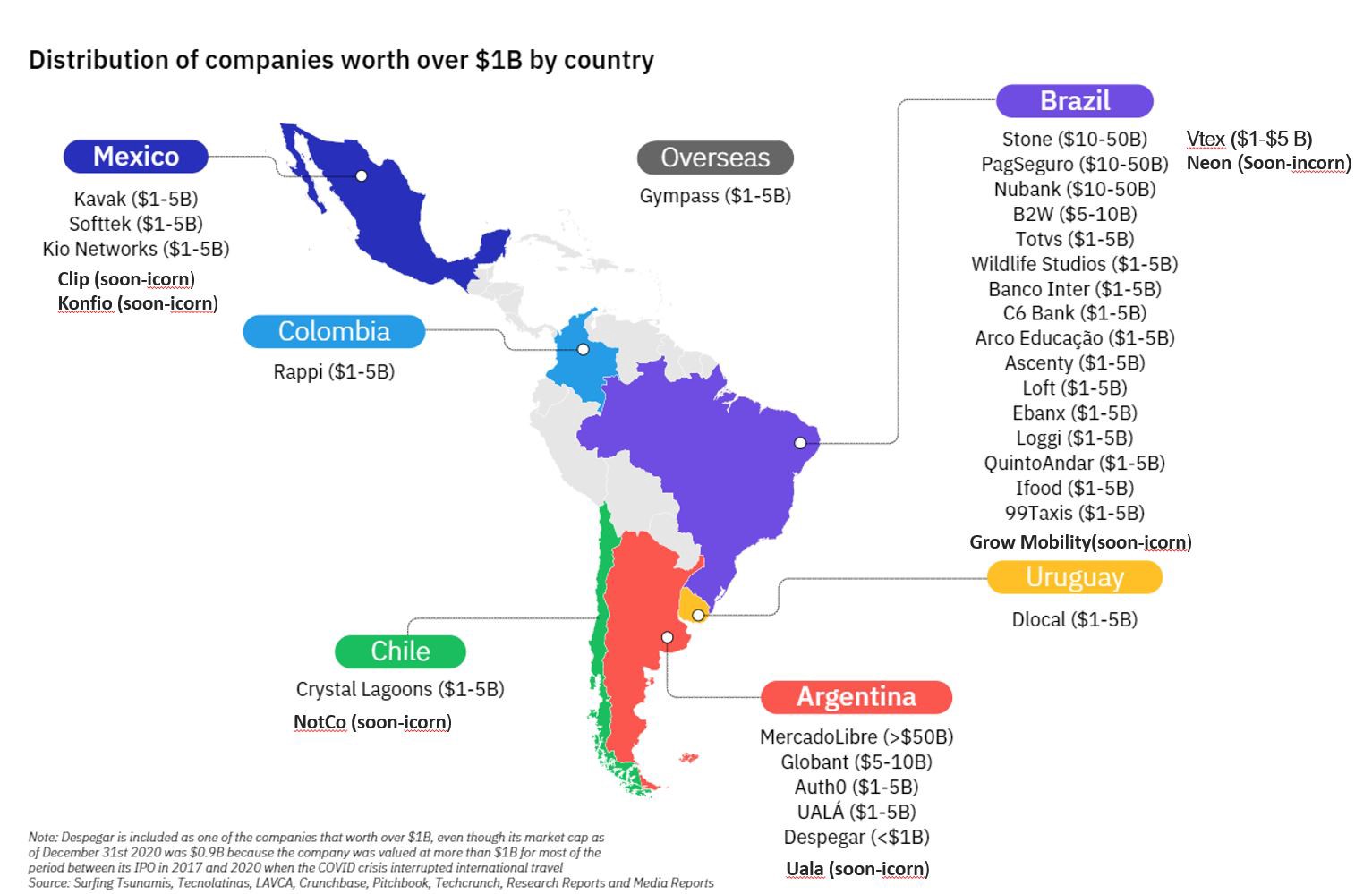

Unicorns & Soon-icorns

Over the last four years new minted unicorns have been popping all over the region. This has paved the way for the new cohort of entrepreneurs all over the region. In the graph below you will be better able to understand some of the unicorns, soon-icorns (estimates based on current valuation, and only few are named), and some of the largest tech companies in the region. To better understand the evolution of the ecosystem, Susana recommends reading Tecnolatinas.

Y Combinator

Additionally, the spur of new companies in the region is incredible and it will only become make the region more diverse. One of the most interesting things that has happened so far in 2021, is the newest YC’s W21 batch, which has 28 Latin companies that range from software companies to wellness. This shows a shift from the traditional companies in Fintech and E-commerce, giving room. This continues to position and validate the region’s entrepreneurial class to investors, especially in Silicon Valley and in the US, where it has an investment filter!

As we see more varied industries, we will continue to attract a spread of global funds.

Challenges

For many years, the main challenges the ecosystem faced were highly risk-averse potential LPs and the low density in the start-up space. The ecosystem has developed at different stages, so the challenges between the more developed ones, like Brazil, Mexico, and Argentina from the emerging ones like Colombia, Chile, Peru differ substantially in access to capital, sectors development and more importantly the size of their markets.

Susana: Brazil, Mexico, and Argentina: Entrepreneurial talent and grit are very deep in the first three countries. Mexico and Argentina tend to think more regional/global than Brazil, but Brazil has a huge internal market of companies, investors and one of the most solid stock exchanges of the region. Even so, Brazilians are beginning to see the strength of the Pacific Alliance corridor and several funds are allocating beyond Brazil. Argentinean entrepreneurs do not found Argentine companies, given the country’s challenges: they from the start are US holdings or in another jurisdiction, which helps them scale and get overseas money. Unfortunately, we’re seeing an exodus of Argentine talent to Uruguay, where a friendlier environment for entrepreneurship exists.

Colombia, Chile, Peru: Colombia and Chile started as very local, Chile very risk averse also, but these have changed and improved. Rappi, Omnibnk helped in Colombia and Notco in Chile to raise awareness of local companies going beyond their countries. Peru started the industry c. 2006 from top down: the first funds were PE and had pension fund $, but the ecosystem and VC side were not developed, so soon the well dried up. It took up from 2006 to only 3–4 years ago to get back on a real path to a VC industry. Angel investors and very small (in size) funds are there, but there is a need to keep developing more entrepreneurial talent, as all Peruvian VC funds are investing in the same companies.

Suad: You are an avid advocate for both women entrepreneurs and for women investors, as you co-founded WeXchange, that still sits at the IDB and you are part of its Board. You co-founded with Marta Cruz WeInvest, a non-profit that gathers women investors in LATAM. How is the ecosystem on that note? Why did women raise almost no rounds last year? Why are there still so little representation in the ecosystem?

Susana: The issue of amounts being raised by women is large and will take time to really turn a corner. Still, a bit is a lack of awareness of the women behind companies like NuBank (Cristina Junqueira is co-founder and CEO), Kavak (Loreanne Garcia, co-founder and Chief People Officer), Loft (Mariana Paixao), and of others are getting funded as well: Unima (Laura Mendoza), and Eolo Pharma (Pia Garat). I could mention women entrepreneurs like Pamela Schrurer from Nubemetrics that got a round last years (entrepreneur from Jujuy, Argentina), but still visibility is a problem.

Many funds in the region not only are incorporating women as their partners (ALLVP, Kaszek, Redpoint, etc) but also boast of having between 25–35% of their portfolio with companies who have a woman co-founder (for example, Jaguar, NXTP, Magma that even has the Brava initiative within the fund to allocate in companies with women co-founders like Jefa). And the more women investors in funds, FOs, etc., the more the ratio will improve. It’s a shift that will take years to complete, but we’re better off today than 10 years ago.

The Future is Bright & Pan-regional!

LatAm’s entire ecosystem is going through one of its best moments, as the future for the region is digital.

Suad: So, what are the opportunities today, that were not there 5 years ago? Where is the ecosystem heading?

Susana: The opportunities are huge because the challenges to solve in the region are huge. Technology has lowered costs for start-ups, there are more soon and unicorns in the investing landscape, and international investors will put pressure on local investors not to miss the gems they have in their own backyard.

Fintech is very relevant in the region, and deep tech (companies like Satellogic, VU, etc.) is proving the innovation pool of the entrepreneurs.

Suad: What is your perspective regarding the current explosion of investments in the region? How do you think this will pan out for future generations of entrepreneurs?

Susana: The future is bright if we don’t fall into exaggerated valuations, which is a present concern. We’re still far from the hot markets of the US, China and SE Asia and their valuations, but we have to be careful. The entrepreneurs of today didn’t live the Internet boom and bust, and there is a danger that history could repeat. I like seeing companies raising rounds that get oversubscribed, but I still think that the comps with the US are not the ones that should be looked at when valuing companies from EMs.

I also see the globalization trend in start-ups thinking big growing even more after the pandemic, when all geographic barriers were eliminated, and we learn how to reach out to the world virtually: this has been an advantage for those entrepreneurs bootstrapping that couldn’t travelled to attend events. Still, networking requires a personal touch, and we’ll go back to that.

For sure the next generation of entrepreneurs, will have to device pan-regional strategies to continue capturing the attention of international funds. As Susana, explains “Investors want to diversify from currency, macro, political risks.”

I wanted to thank Susana Garcia-Robles for this incredible opportunity to share all her amazing insights into the LatAm’s VC evolution.